FDI

Foreign investment in India is primarily governed by the FDI policy formulated by the secretariat for industrial assistance (SIA), the Department of Industrial policy and promotion (DIPP), the foreign investment promotion board (FIPB) and foreign exchange regulations, which are governed by the RBI. Under the present policies and regulations, foreign investment in India is possible through the following avenues:

Foreign investment in India is primarily governed by the FDI policy formulated by the secretariat for industrial assistance (SIA), the Department of Industrial policy and promotion (DIPP), the foreign investment promotion board (FIPB) and foreign exchange regulations, which are governed by the RBI. Under the present policies and regulations, foreign investment in India is possible through the following avenues:

A. As FDI;

B. By FIIs, directly, via the Portfolio investment scheme(PIS);

C. By NRIs/persons of Indian origin (PIO), directly and indirectly, via the PIS;

D. By qualified foreign investors, via the PIs; and

E. By foreign venture capital investors (FVCIs)

FDI Policy

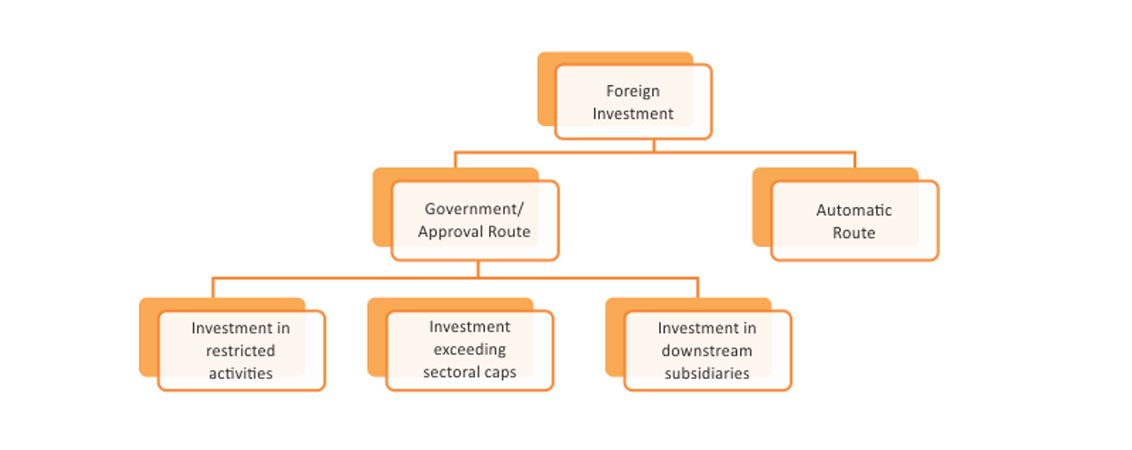

The government of India releases a compendium of FDI policy every six months. Foreign investment in India can be made either through the automatic route or the approval route.

Automatic Route

Under the automatic route, no prior regulatory approval is required from either the RBI or FIPB. Under this route, investors are required to notify the concerned regional office of the RBI within 30 days of receiving investment money in India and to file the required documents and details of the shares allotted, with the same regional office, within 30 days of issuing such shares to the respective foreign investors.

Approval/Government route

FDI in business sectors not covered under the automatic route requires prior approval from the Government of India. Applications for foreign investments that need prior governmental approval are required to be submitted to the FIPB.

Foreign persons who can invest in India under the FDI regime

A non-resident entity (other than a citizen of Pakistan or Bangladesh or an entity incorporated in Pakistan or Bangladesh) can invest in India subject to compliance with the extent FDI regulations.

A person who is a citizen of Bangladesh or Pakistan or an entity incorporated in Bangladesh or Pakistan can invest in India under the FDI provisions, subject to receiving the prior approval of the FIPB.

WE HAVE GOT PROFESIONALLY RICH EXPERINCE IN PROVIDING SPECIALIZED SERVICES IN ALL SECTORS OF THE INDUSTRY

Quality | Trust | Integrity